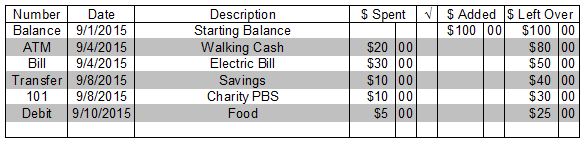

Wow does that look scary or what? I still remember when I saw my first one, and my brain went completely blank. So for the sake of this tutorial let me change the values just a little bit for you, but the real ones will look like the one above.

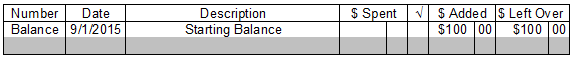

Getting Started:

- Now when you first get the Check Register, in the first column under number write BALANCE

- Under the Date write todays date

- Under Description (Transaction) write Starting Balance

- Under $ Added (Deposit) Write the exact amount in the checking account after everything has cleared (the money has been taken out and put into someone else’s account)

- Under $ Left Over or Balance Write the same Amount as you did in the $ Added (Deposit Column)

Now for the hard part:

You Must do this every time any money leaves your account, IE. Writing a check, use your debit card, transfer money or pay a bill automatically/electronically…

In the first column either write the

- Check Number

- Bill (Electronic bill IE. power etc.)

- ATM for ATM Withdrawal

- Debit for Debit Card (Using your like a credit card at a store)

- Transfer (moving money to savings or other account)

- The next column write the Date (todays date is fine).

- In the $ Spent (withdrawal) column write the amount you spent, the first space is for the Dollars and the Second is for the cents.

- In the $ Left Over ($) column subtract the amount you spent from the line above. Write this total on the line. This is how much money you have left to spend.

In this example I spent

- 9/4/2015 – ATM to withdraw $20

- 9/4/2015 – I paid a $30 electric bill automatically

- 9/8/2015 – I transfered $10 to saving

- 9/8/2015 – I wrote a Check #101 for $10 to charity

- 9/10/2015 – I bought $5 worth of food with my Debit Card

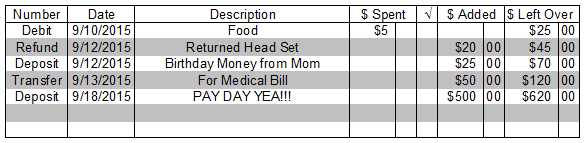

More of the same just in reverse:

When you get money, IE. Pay Check, Transfer Funds or a direct deposit, you need to show the deposit back into the account.

- In the first column either write the

- Deposit

- Transfer

- Refund

- The next column write the Date (todays date is fine).

- In the $ Added (Deposit) column write the amount you spent, the first space is for the Dollars and the Second is for the cents.

- In the $ Left Over ($) column add the amount you spent from the line above. Write this total on the line. This is how much money you now have to spend.

In this example I

-

- 9/12/2015 – Returned a Head Set that was defective for $20

- 9/12/2015 – Deposited my Birthday money from Mom $25

- 9/13/2015 – Moved $50 from savings to cover an unforeseen medical bill

- 9/18/2015 – My Pay check was direct deposited

Conclusion and final notes:

The fact that there are more days in the month then there is money in your checking account is no reason to risk going to jail, insufficient fund fees, companies not accepting your checks… Simply keeping track of how much money is available and using only that amount will help save you from this frustration. Face it, if you bounce the check they will still get their money and you have not solved anything. In simple you caused more aggravation for them and more importantly yourself. On top of the initial financial cost to you, you now need to go down to the bank and go through the process of straitening out the mess that didn’t need to happen anyway.

Final notes: as you use the account you will have deposits and withdrawals next to each other. They don’t need to go in separate sections. Just put them in the book as you spend the money. If you fill a register, and you start a new one, put the last left over balance in the first line of the new register, and fill out the new register the same way you started in the beginning. At the end of the month reconcile your account to make sure your balance and the balance the bank has are the same, and to make sure that no one has borrowed your identity without your permission. Catching these crimes early can save you thousands of dollars.

Write in your book every time, and at the time you spend or deposit any money. Don’t make any exceptions, because inevitably one will forget what they wrote a check for or used their debit card.

– J –