Are you or do you know one of those people who like to check their bank balance by going to the nearest ATM, checking by phone or just adding it up in their head? This may have worked years ago, but simply it’s one of the most profitable ways for a bank to make money off their checking accounts. Simply if you are worried about making money, you may do well to work to save money instead.

Why does this even happen?

Many banks still push all of their bank to bank transactions through a clearinghouse. Most banks still use this method, and it is still extremely common that it may run 1-3 days behind. The bills you have paid by phone and checks don’t always show up right away. Just because the money is in the account, doesn’t mean you have it to spend. In fact, there are many people who use the simple technique of spending the money until it hits zero, borrow the money to get to the next paycheck, then pay back the short-term loan, pay any check fees and then do it all over again.

Many banks still push all of their bank to bank transactions through a clearinghouse. Most banks still use this method, and it is still extremely common that it may run 1-3 days behind. The bills you have paid by phone and checks don’t always show up right away. Just because the money is in the account, doesn’t mean you have it to spend. In fact, there are many people who use the simple technique of spending the money until it hits zero, borrow the money to get to the next paycheck, then pay back the short-term loan, pay any check fees and then do it all over again.

Don’t go broke paying bank fees:

The lost art of not going broke because you overspent, and bounced checks, overdrew your checking account (IE debit card or ATM card) has now become a trend. For those who don’t get it, it’s something you should have learned at school, when you opened your checking account or after your first Bankruptcy / Court hearing for bouncing checks. At some point not being able to open new checking accounts, write checks because you’ve been banned or … The $1-$5 for cashiers checks and money orders, the overdraft fees and the $30-$40/bounced check from your bank and the $25-$100 from the merchant can add up to thousands a month and a jail sentence. Even if the bank forgives one or two fees for you, they are just baiting you in to do it again. It’s human nature once it happens once, you believe you will be able to get it again.

The lost art of not going broke because you overspent, and bounced checks, overdrew your checking account (IE debit card or ATM card) has now become a trend. For those who don’t get it, it’s something you should have learned at school, when you opened your checking account or after your first Bankruptcy / Court hearing for bouncing checks. At some point not being able to open new checking accounts, write checks because you’ve been banned or … The $1-$5 for cashiers checks and money orders, the overdraft fees and the $30-$40/bounced check from your bank and the $25-$100 from the merchant can add up to thousands a month and a jail sentence. Even if the bank forgives one or two fees for you, they are just baiting you in to do it again. It’s human nature once it happens once, you believe you will be able to get it again.

Let’s go through an example… You use your debit card for $10 to a local store that takes your account down just $10. This check already cleared, when you rent check finally came through, and the account was underfunded. The bank charged you an overdraft fee of $30 to stop you from having issues. But, now your electric bill was automatically withdrawn, your car payment, that check you wrote a month ago for your moms birthday… And the list goes on. Now you have -$160 in your bank account. No wonder banks give out free checking accounts. Your working for them and you’re not even on the payroll. Did you know this mysteriously effects your credit history and can lead to a jail sentence for repeat offenders?

No!!! Make it stop!!!

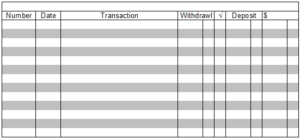

Now a Check Journal can put a stop to this, but that doesn’t mean your not going to have more days in the month then your paycheck can cover, but hopefully you will stop paying overdraft fees, and insufficient fund fees (Bounced checks), and you can avoid thousands in court cost, and lost wages because you were busy in jail partying like a rock star.

First I want to go on record saying that if you have a job, and your boss is paying you by the hour, you already know multiplication. Otherwise, your boss could be ripping you off. You know the number of hours your work times your hourly wage equals your paycheck. Otherwise written as Hours X $ Hourly = Pay Check. So I don’t wish to hear you cant do basic addition and subtraction. The preferred method is a handwritten Journal or Register you can get at your bank. They are usually free, so don’t panic, or if the archaic art of writing scares you-you can use an excel spreadsheet or an app. Figure out your road for this. I again will go on record the advantage of handwriting it lets you see the actual exchange of money. So you see the numbers as you bring them down in the register, and you see a live up to date balance of your account.

First I want to go on record saying that if you have a job, and your boss is paying you by the hour, you already know multiplication. Otherwise, your boss could be ripping you off. You know the number of hours your work times your hourly wage equals your paycheck. Otherwise written as Hours X $ Hourly = Pay Check. So I don’t wish to hear you cant do basic addition and subtraction. The preferred method is a handwritten Journal or Register you can get at your bank. They are usually free, so don’t panic, or if the archaic art of writing scares you-you can use an excel spreadsheet or an app. Figure out your road for this. I again will go on record the advantage of handwriting it lets you see the actual exchange of money. So you see the numbers as you bring them down in the register, and you see a live up to date balance of your account.