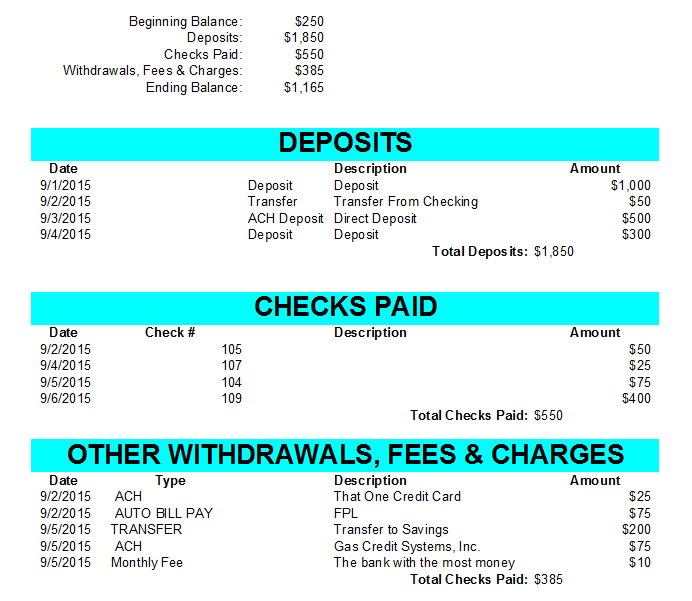

The best way to handle this task is to select a date or a day (Ie. First Friday of every month). Take your printed statement from the bank, or you can use the electronic register on-line provided by your bank for free. If both totals match, be sure to check to make sure everything you have put into your register still matches to the banks accounting.

- Go down the list of items that have been cleared by the bank.

- Match up the entries on your register to the items on the bank statement.

- Use the checkbox column in the register to mark the ones that have already cleared the bank

- Verify the totals in your register match the ones your statement.

- Add up all the checks and payments that do not have check marks

- Add up all of the deposits that do not have check marks

- Take the last line of your $ (leftover) column + total from step 2 – subtract the total from step 3

- If the number matches the one that is at the current balance from the bank your done

- If the number doesn’t match then check your number and contact your bank if needed

Conclusion and final notes:

Let’s face facts, most people are too busy to use a check register, let alone balance it a the end of the month. The advantages of doing this are that it allows you to make sure your account is not overdrawn, it lessens the chances of fraud and identity theft, and most of all it gives you a clear visual of where you are spending your money. This is clearly a win for anyone who does it on a monthly basis.

– J –